If you’re a self-employed individual, contractor, or anyone who submits self-assessment tax returns in the UK, you may have encountered the term SA302 form. This document serves as evidence of your income and tax paid and is often requested by lenders during mortgage applications or by other financial institutions. In this article, we’ll explain what an SA302 is, how to obtain one, and provide a clear SA302 example to help you understand its format and purpose.

What is an SA302 Form?

The SA302 form is an official document issued by HM Revenue and Customs (HMRC) that summarises your income and tax details for a specific tax year. It confirms the tax calculation resulting from your self-assessment tax return. Lenders often request an SA302 when you’re applying for loans, mortgages, or other financial products to verify your income.

Don’t leave your mortgage to chance.

Let our experienced brokers guide you step by step. Start your application now!

How to Get an SA302 Form

There are two main ways to obtain an SA302 form:

- Through your HMRC Online Account: Log in to your account on the HMRC website and navigate to the Self Assessment section. From there, you can view your tax calculation and print or download your SA302.

- By Requesting from HMRC: If you can’t access the online system, you can call HMRC and request an SA302. HMRC will send it to you by post, which can take a few days.

What Does an SA302 Include?

The SA302 form provides the following information:

- Your income for the tax year

- Tax due or paid

- Tax reliefs and allowances claimed

- National Insurance contributions

- Any adjustments or outstanding amounts

This concise summary makes it an essential document for financial assessments.

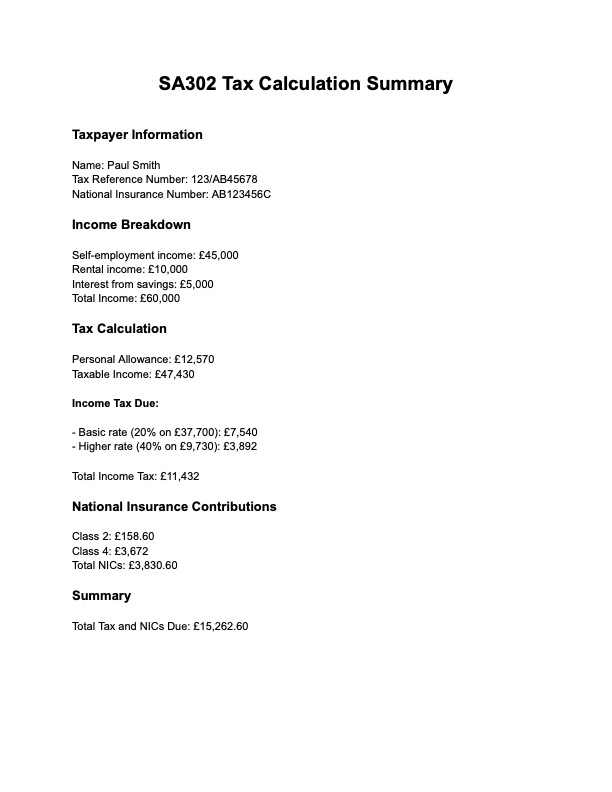

SA302 Example

Here’s a simplified SA302 example to give you an idea of its format and information:

Tax Calculation Summary for the Year 2024-2025

- Taxpayer Name: John Doe

- Tax Reference Number: 123/AB45678

- National Insurance Number: AB123456C

Income Breakdown

- Self-employed income: £45,000

- Rental income: £10,000

- Other income: £5,000

- Total income: £60,000

Tax Calculation

- Personal Allowance: £12,570

- Taxable income: £47,430

- Income tax due: £8,986

- National Insurance contributions: £3,672

Total Tax and NI Paid: £12,658

This example illustrates the key sections of an SA302 form and the kind of information lenders or financial institutions look for.

Download the example:

Why is an SA302 Important?

The SA302 form is crucial for proving your income, especially if you’re self-employed or earn through non-salaried means. Lenders rely on it to assess your financial stability, and in some cases, it may even be required to rent property or apply for benefits.

Understanding the SA302 form is essential for anyone managing their taxes under the UK Self Assessment system. By knowing what it includes and how to access it, you can ensure you’re prepared for financial evaluations. The SA302 serves as a trusted document to verify your income and tax compliance, making it a key tool for self-employed individuals and small business owners.

If you’re applying for a mortgage or loan, make sure your SA302 is up to date and accompanied by your HMRC tax year overview for a smooth process.

FAQs

Can I use an accountant’s version of the SA302?

Yes, many lenders now accept a tax calculation provided by your accountant or a tax software printout, as long as it’s accompanied by the HMRC tax year overview.

How long does it take to get an SA302?

If downloaded online, it’s instant. If requested by post, it can take up to two weeks.

What if my income varies significantly?

Lenders often ask for SA302s from multiple years to understand fluctuations in your income.

Continue Reading

Switching from interest-only to a repayment mortgage

Mortgage affordability calculator

Does applying for multiple mortgages affect credit?

How to get a mortgage with 1 years’ accounts

How much can I borrow for a mortgage?

Mortgage with a gifted deposit

Joint mortgage with bad credit